Eating Healthy on a Budget: Affordable Meal Ideas

Maintaining a healthy diet is essential for overall health and wellness....

Travel insurance provides a great sense of security for travellers.

If you have concerns about how you might pay for any unexpected events, then ask yourself why. Perhaps there is something you can do to fix it? That’s where single-trip travel insurance comes in.

With the right level of cover, all your holiday disasters can be covered for one fee, so no matter what happens, you won’t need to worry about covering the costs yourself.

Single trip travel insurance is exactly what its name suggests. It provides protection for a limited period whether travelling for one holiday or a business trip, single trip travel insurance is the ideal policy.

Travel insurance is essential for any holiday, and the single-trip cover is the most affordable. Prices start very low however you shouldn’t be tempted to buy the cheapest policy without first checking if it offers enough cover for your trip.

Single-trip travel insurance provides you with the assistance and security to explore the world. It is designed to protect you against risks that could occur whilst travelling. This may range from minor incidents such as missed airline connections and delayed luggage to more serious issues, including injuries or major illness.

Typical single-trip travel insurance will cover:

The last thing you want is to report an incident only to find that your policy doesn’t cover you – or worse, you’re not even covered at all. Take a look at both the terms and conditions of your travel insurance policy.

Here are some of our top picks for cheap travel insurance:

With Leisure Guard, you can grab great value cover from just £6.52 for a single trip in Europe.

Coverwise protects its customers for as little as £5.15.

Cover For You is the perfect choice with prices from £11.00.

Save money on your travel insurance with prices from £9.41 per trip with Direct Travel.

The cost of travel insurance varies depending on where you are travelling to, the length of your trip and additional cover. Single-trip travel insurance can cost as little as a few pounds however opting for the cheapest insurance isn’t always the best option. The cost depends on:

Wherever you are travelling, prices may vary. Here are recent cost comparisons based on the average price for a 1-week single-trip policy.

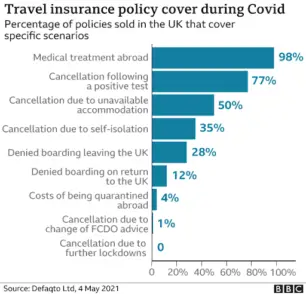

As insurance companies adapt to the new reality of Covid-19 regulations, some travel insurers now provide enhanced coverage for Covid-19. Such policies could include trip cancellation, unlimited medical expenses and transportation home, for example, Staysure, Post Office and Virgin Money.

If you have travel insurance as part of a bank account or credit card, ensure you check the policy terms before embarking on your trip, as well as ensuring the policy covers your health and additional needs.

An example of a bank providing travel cover is the Co-operative bank. Their everyday extra bank account holds a fee of £15 a month, with the benefit of worldwide travel insurance provided by AXA travel insurance.

The policy provides cover for you, your family or partner (if you are travelling with them) and children up to 22 years even when travelling independently, with no excesses to pay on claims.

If you’re planning a trip, you should be mindful if something unexpected happens, it is important to have travel insurance. Do your research before departure as it’s crucial to examine the range of policies available and choose the one you think will best cover you for your trip.

Travel with confidence.