Unsecured Loan PPI Claims

Unsecured loans are bank loans that are not secured against the value of your home. Over the last two decades, a huge number of these loans were sold bundled with PPI policies that borrowers either didn’t agree to or didn’t fully understand. Shocking as it may be, the endemic scale of these mis-selling practices is now common knowledge, and lenders have been forced to set aside massive sums in order to ensure they are able to repay the cost of PPI to the many customers who have paid for the product unnecessarily, or under false pretences.

The Scale of Unsecured Borrowing in the UK

Recently published figures show that, at the end of May 2012, unsecured personal borrowing in the UK totaled £208 billion. The average UK adult owed £4,225 on unsecured borrowing and overdrafts. Meanwhile, the figures for March 2012 show a 58% year-on-year increase in family debt levels. Clearly, unsecured lending is extremely widespread, which means that there is a massive number of people who may have been mis-sold PPI on an unsecured loan.

Establishing the Validity of an Unsecured Loan PPI Claim

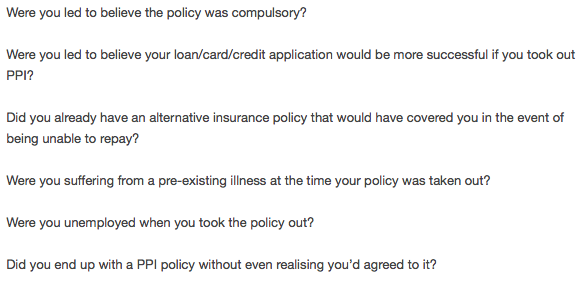

Here are some of the questions you will need to answer to establish whether mis-selling has occurred in your case:

Get PPI Compensation

Either:

- Claim directly

- or use a claims management company

Claiming directly means you will keep 100% of the compensation awarded to you and claiming is simple. You just need to contact your provider with as much info about your unsecured loan payment protection insurance policy as you can, the reasons you believe it was mis-sold and to request a refund plus interest.

Your provider has 6 weeks to deal with your claim and if you are not satisfied with the response you can appeal through the Financial Ombudsman.

The alternative is to use a Ministry of Justice Licensed PPI Claims Management Company, but this will incur a fee.