Eating Healthy on a Budget: Affordable Meal Ideas

Maintaining a healthy diet is essential for overall health and wellness....

Get ready for university the right way!

With so many new expenses, a student bank account can help you budget, and plan your student days. This is why it’s so important to choose a student bank account that suits your needs.

A student bank account is an ideal way for university students to save money, pay rent, take care of tuition fees or manage other daily expenses; allowing you to access your money easily with great additional benefits such as freebies and interest-free overdrafts!

As soon as you receive your offer letter from UCAS (depending on your chosen bank or building society) you should be eligible to open a student bank account.

It is recommended to have this in place as soon as possible, as opening an account can take a couple of weeks to process.

As most banks offer interest-free overdrafts on student bank accounts, It’s important to consider that the UK Law doesn’t allow under 18’s to get an overdraft. Should you open a student account before you’re 18, you can apply for an overdraft once you turn 18.

UK students are required to present:

Once your account is open, update your Student Finance body and inform them of your new bank account details.

International students are required to present:

Most banks support online applications but ensure to double-check the type of account you are opening is an international student bank account as opposed to a UK student bank account; as these accounts require more documentation.

Here are six of the best and most recommended student bank accounts with amazing offers available.

Sort by:

HSBC offers a single student current account to both UK national and international students who have lived in the UK for the past 3 years.

The account comes with multiple benefits for eligible students, including a guaranteed no-interest overdraft of £1,000 in your first year, rising to £3,000 by year 3.

You can also enjoy an £80 cash reward! Plus, the choice of a £20 UberEats voucher or a year of unlimited next-day delivery with ASOS Premier. All you need to do is make 5 debit card transactions within a month of opening your account.

Why we like it

You can also enjoy an £80 cash reward! Plus, the choice of a £20 UberEats voucher or a year of unlimited next-day delivery with ASOS Premier. All you need to do is make 5 debit card transactions within a month of opening your account.

Nationwide offers a flexible, interest-free and fee-free arranged overdraft on their FlexStudent current account.

Nationwide know money can be tight when at university, which is why they have arranged an overdraft which will grow with your studies. You’ll start with a £1,000 arranged overdraft limit in year 1, rising to £2,000 in year 2, and £3,000 in year 3.

Why we like it

Completely fee-free, even oversees

Up to £3,000 arranged overdraft limit whilst you study

Bank how you like. Online or via phone

Natwest draws in students with offers including £50 paid into your account as long as you meet the offer criteria and a Tastecard where you can get 2 for 1 or 50% off your food bill at thousands of UK restaurants or discounts for your cinema trips.

If you are an international student, and you’ve lived in the UK for more than 3 years, you can apply for the student account; however, if you’ve lived in the UK for less than 3 years, you are not eligible for a student account at Natwest.

Why we like it

Lloyds offer a fee-free arranged overdraft, of up to £1,500 in Years 1 to 3 and up to £2,000 in years 4 to 6, and as long as you stay in credit, you won’t have to pay a monthly fee.

You’ll also gain a free TOTUM card if you open your account between 1st August and 31st October 2021. A TOTUM card allows you to save money on everyday shopping, days out, entertainment and more.

Why we like it

Santander’s account for students is called the 1|2|3 Student Current Account. This account offers some student-friendly benefits such as a free 4-year railcard, which provides a reduced price for rail fares, and discounts of up to 15% at multiple partner retailers!

Why we like it

Interests paid on balances of £300 – £2,000, and an arranged overdraft limit will begin at £1,500 in Year 1, rising to £2,000 in Year 5.

Barclays’ student accounts are aimed for students in an undergraduate university program that lasts at least 2 years, a post-graduate program of at least 1 year and higher apprentices of level 4 or above.

This account gives the option of a fee-free overdraft of up to £500 from day one and increases it up to £3,000 by your third year of study.

Keeping your interests at heart, Barclays gives you access to Perlego with unlimited access to 500,000 academic and non-fiction books. If you open your account by 30th November 2021.

Why we like it

Digital banks are a great way to manage your banking solely via mobile as opposed to branches.

Students use this to easily keep track of their incomings and outgoings however, Monzo and Starling both don’t offer a specific student account providing a disadvantage to those offering a student account with benefits.

This is a common question among students. Whilst it’s usually not possible to open more than one student bank account, you can open a new current account for everyday spending. An example of banks who charge no monthly fee to maintain are:

Once UCAS receives your application, they create a personal status code which is sent via email and allows banks to confirm your entitlement to student bank accounts. This is beneficial as it will speed up the process of opening your student bank account by confirming you are an eligible student applying. Remember, each code given by UCAS is unique to each applicant and it is strictly not to be shared with others.

You can find your UCAS student code once you have submitted your application to UCAS and it is approved. UCAS will then give you your unique 16 digit code which can be accessed through your UCAS track online portal where it should ask you if you are opening a student bank account.

Once UCAS receives your application, they create a personal status code which is sent via email and allows banks to confirm your entitlement to student bank accounts.

As with most bank account setups, you will be credit checked, and this could be especially difficult for students as you could potentially hold less data for banks to review.

This could impact a student’s opportunity to open a student bank account however, there are many ways to increase your credit score.

You can invest in a student credit card which can be a great way to cover unexpected expenses and build a good credit history. Banks such as HSBC offer this service.

The answer is yes! You can switch student accounts. As most providers offering student accounts are part of the Current Account Switch Service (CASS), the process of switching your existing bank account is an easy transition!

However, you must ensure you check to see if the bank account you switch to has a matching overdraft limit as this isn’t transferable. Below are examples of banks that offer a switch:

If you’re planning to study in the UK and are looking to secure your student bank account, some banks offer the opportunity to set up a bank account before you arrive.

It may be worthwhile to check with your current bank provider if they are linked to UK banks, as you will already be on their customer database to make the process smoother.

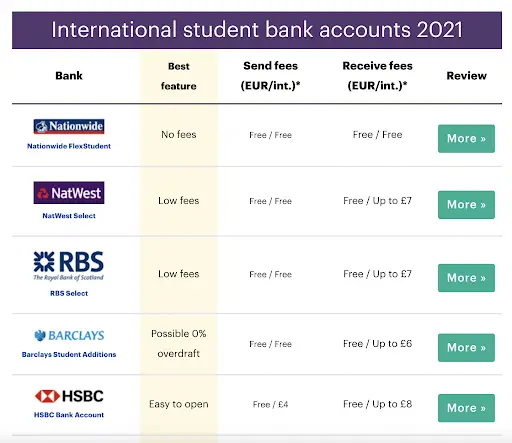

Below are some of the best international student bank accounts for 2021, taking into account the fees.

It’s important to consider what will happen to your student bank account after you graduate. For example, if you have an overdraft, when do you need to pay this back? What is the interest rate?

Once you graduate, there is the option to switch to a graduate bank account. If you already hold a student account, you’re instantly able to convert to a graduate account once you finish university.

There is also no need to stick to the same bank if you find a better option!

Setting up your student bank account will make managing your money a whole lot easier leaving you more time to enjoy your life at university!