Eating Healthy on a Budget: Affordable Meal Ideas

Maintaining a healthy diet is essential for overall health and wellness....

Location, location, location! With the average house price rising, start your search with a realistic picture of what you can afford, then set out to find a home and location that meets your criteria.

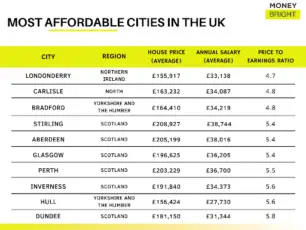

The UK’s largest mortgage lender, Halifax, analysed the average house prices and earnings over the past 12 months to July 2021 to determine which UK cities are the most and least affordable places to live.

See the cheapest cities to live in and the least affordable cities in the UK below!

Halifax House Price Index reported property prices rose by 7.6% from July 2020 to July 2021.

More specifically, house prices inflated by 0.4% in July 2021, increasing the average cost of the property by £1,122. This pattern is expected due to the recovery from the first Coronavirus lockdown; however, typical prices now reach just over £261,000, more than £18,000 higher than July 2020.

Russell Galley, Managing Director, Halifax, said:

“Rising house prices have generally continued to outstrip wage growth, which reduces overall affordability.”

Average house price, UK: 2017 to 2021

When on the lookout for a place to live, why not check out areas of the UK with the lowest property prices over the average salary?

Looking at the affordability of homes in the UK, only cities that have less than six times average annual earnings can be considered ‘affordable’ for example, Londonderry offers a better value of housing to income than any other UK city.

Russell Galley, Managing Director at Halifax, said that people should look for affordable housing in the north of England. He said:

“Affordability is significantly better in the north, and there are now just two cities – Plymouth and Portsmouth – with better than average affordability in the south.”

Halifax analysed the average annual salary and average house prices in the 12 months leading to July 2021 for the most affordable cities in the UK.

Based on the Halifax House Price Index, it is apparent that buying a home in some UK cities remains a challenge.

According to the Halifax House Price Index, the top five most expensive cities in the UK are Winchester, Oxford, Truro, Bath and Chichester. The average house in the area costs 14 times a typical resident earns in a year.

In 2021, for the first time in 5 years, Winchester pushed Oxford out of the top spot, with a home typically costing 12.4 times the average salary in the city.

Halifax analysed the average annual salary and house prices in the 12 months leading to July 2021 for the least affordable cities in the UK.

The average house price in Hull is £156,424, while Winchester has the highest average house price in the UK at £630,432, meaning you could buy four homes in Hull for the price of one in Winchester.

According to Halifax, the average home price in different cities has risen by 10% in one year. Salisbury has seen the biggest rise of 36%, Hereford 29% and Lancaster and Birmingham are at 19%.

The cost of living in Gloucester is growing at more than twice the UK average. Prices have increased by 101% in Gloucester since 2011 compared to the UK average of 71%.

Zoopla say that the number of homes for sale this year has fallen by more than a fifth compared with last year. As a result, they say there is now “a severe shortage” of homes.

When looking for a house to buy, one of the most important factors is the area. Look for a location that meets your requirements. Whether thriving nearby towns, local demographics and neighbourhoods, transport links or employment, this will all determine the location and price that is suitable for you.

It’s worth remembering that it is possible to buy a house in smaller towns and rural areas, and the price is likely to be lower than in cities.

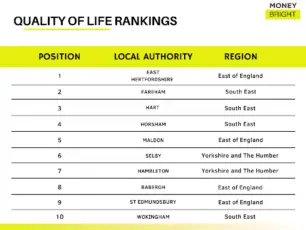

In 2020, Halifax issued a press release based on Quality of Life. They took into account the considerations homebuyers look for when choosing a location to live.

“Factors relating to wellbeing played a significant role in securing the top three places for East Hertfordshire, Fareham, and Hart – with high scores on general health and happiness. East Hertfordshire and Hart score well on life expectancy, where males can expect to live an average of 82.5 years, 3 years above the national average and females to 85, 2 years above the national average.

Those living in Hart and Fareham score highly for life satisfaction – 8.2 out of 10 on average, compared to 7.8 for the UK. Employment levels are also significantly higher – 87.2% in Hart and 82.2% in Fareham, compared to 75% for the rest of the country.”

It can be hard to predict how the housing market will develop, but the best place to start is the UK house price index when looking into the housing market and deciding what will be the right move for you.

Russell Galley, Managing Director, Halifax, said:

“Overall, assuming a continuation of recent economic trends, we expect the housing market to remain solid over the next few months, with annual price growth continuing to slow but remaining well into positive territory by the end of the year.”

Image Credit: Tecmark